The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Blog Article

Amur Capital Management Corporation Can Be Fun For Anyone

Table of Contents7 Simple Techniques For Amur Capital Management CorporationFascination About Amur Capital Management Corporation7 Simple Techniques For Amur Capital Management CorporationWhat Does Amur Capital Management Corporation Mean?The Buzz on Amur Capital Management CorporationThe Ultimate Guide To Amur Capital Management CorporationA Biased View of Amur Capital Management Corporation

A low P/E ratio might suggest that a firm is underestimated, or that financiers expect the company to deal with extra tough times ahead. Capitalists can use the typical P/E proportion of various other business in the exact same market to create a standard.

Indicators on Amur Capital Management Corporation You Need To Know

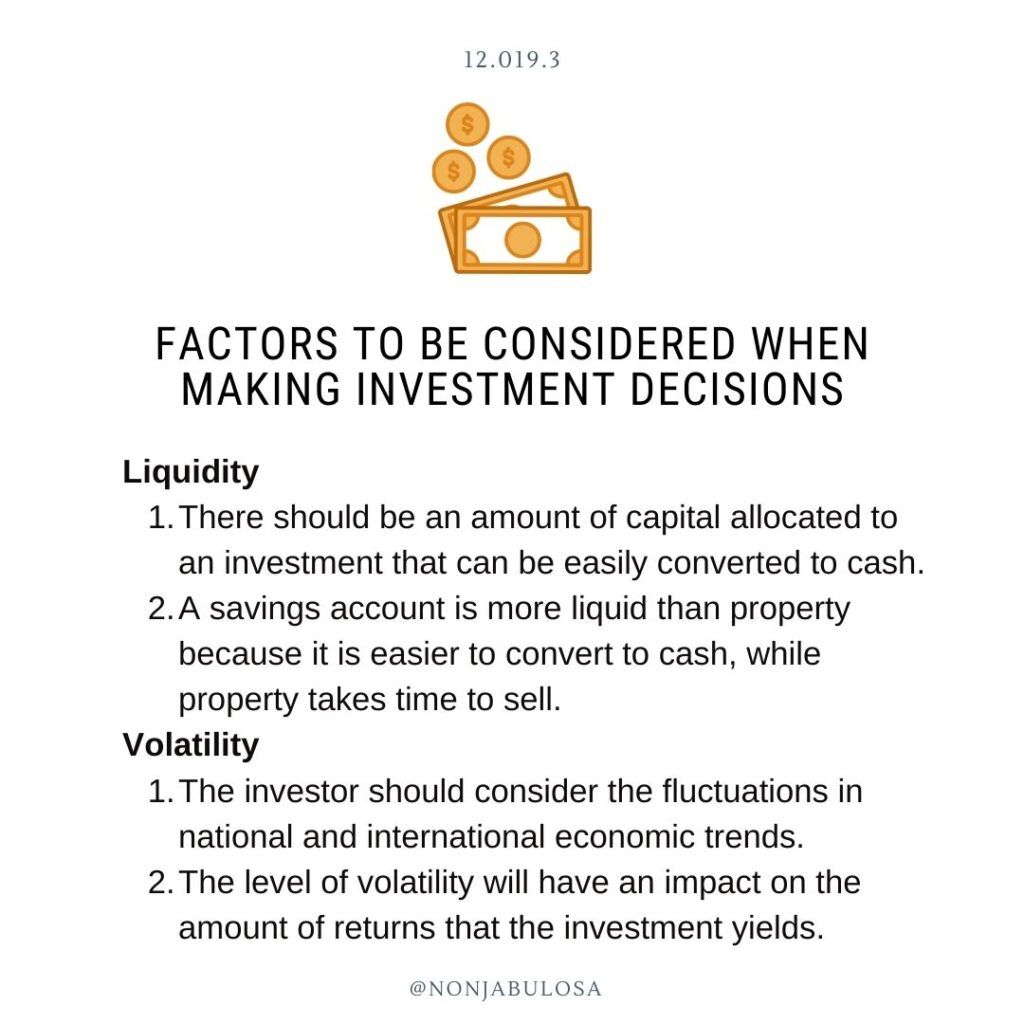

The standard in the vehicle and truck sector is simply 15. A stock's P/E ratio is very easy to locate on the majority of financial coverage internet sites. This number indicates the volatility of a supply in comparison to the marketplace in its entirety. A safety and security with a beta of 1 will exhibit volatility that corresponds that of the marketplace.

A supply with a beta of above 1 is theoretically a lot more unstable than the marketplace. A safety and security with a beta of 1.3 is 30% more volatile than the market. If the S&P 500 rises 5%, a stock with a beta of 1. http://www.place123.net/place/amur-capital-management-corporation-surrey-copyright.3 can be anticipated to climb by 8%

3 Easy Facts About Amur Capital Management Corporation Described

EPS is a dollar number representing the section of a company's profits, after taxes and participating preferred stock returns, that is assigned to every share of ordinary shares. Investors can use this number to determine exactly how well a firm can deliver worth to shareholders. A higher EPS begets greater share prices.

If a company regularly fails to provide on earnings forecasts, an investor may want to reconsider purchasing the supply - passive income. The calculation is straightforward. If a company has a take-home pay of $40 million and pays $4 million in rewards, then the staying sum of $36 million is divided by the variety of shares exceptional

Amur Capital Management Corporation Things To Know Before You Get This

Financiers commonly obtain curious about a stock after reading headings concerning its phenomenal performance. Simply remember, that's yesterday's news. Or, as the spending pamphlets constantly expression it, "Previous performance is not a predictor of future returns." Sound investing choices need to think about context. A check out the trend in prices over the previous 52 weeks at the least is required to get a feeling of where a stock's price might go next.

Let's look at what these terms suggest, how they vary and which one is finest for the ordinary capitalist. Technical experts brush via huge volumes of data in an initiative to forecast the direction of supply prices. The information consists largely of previous pricing information and trading quantity. Fundamental evaluation fits the requirements of a lot of investors and has the benefit of making good feeling in the actual globe.

They think rates follow a pattern, and if they can figure out the pattern they can capitalize on it with well-timed professions. In current decades, innovation has actually enabled even more capitalists to exercise this style of investing because the tools and the data are more accessible than ever. Essential analysts take into consideration the inherent value of a stock.

Amur Capital Management Corporation for Beginners

Much of the concepts talked about throughout this item are common in the fundamental analyst's world. Technical evaluation is finest suited to somebody that has the time and comfort level with information to place infinite numbers to utilize. Otherwise, basic evaluation will certainly fit the requirements of most capitalists, and it has the benefit of making good feeling in the actual world.

Broker agent fees and common fund expense ratios pull cash from your portfolio. Those expenditures cost you today and in the future. As an example, over a duration of two decades, yearly fees of 0.50% on a $100,000 investment will lower the portfolio's value by $10,000. Over the same duration, a 1% charge will reduce the very same profile by $30,000.

The fad is with you (https://www.bitchute.com/channel/wfTS3rtGiDAM/). Take benefit of the trend and store around for the cheapest expense.

The Best Guide To Amur Capital Management Corporation

, continue reading this environment-friendly area, beautiful sights, and the area's condition variable plainly into residential building evaluations. A vital when thinking about property place is the mid-to-long-term sight pertaining to how the location is anticipated to evolve over the financial investment period.

Amur Capital Management Corporation Fundamentals Explained

Thoroughly assess the possession and desired use of the prompt areas where you plan to invest. One way to accumulate information about the leads of the location of the residential or commercial property you are taking into consideration is to call the city center or other public companies in cost of zoning and urban planning.

Residential property assessment is essential for financing during the acquisition, sticker price, financial investment analysis, insurance policy, and taxationthey all rely on property evaluation. Frequently utilized realty valuation techniques include: Sales contrast technique: recent equivalent sales of residential or commercial properties with comparable characteristicsmost typical and suitable for both brand-new and old buildings Expense approach: the expense of the land and construction, minus devaluation suitable for brand-new building and construction Earnings technique: based on anticipated cash money inflowssuitable for rentals Offered the low liquidity and high-value investment in property, an absence of quality deliberately may result in unexpected results, consisting of monetary distressspecifically if the financial investment is mortgaged. This uses normal income and lasting value appreciation. This is typically for quick, little to medium profitthe typical home is under building and construction and marketed at an earnings on completion.

Report this page